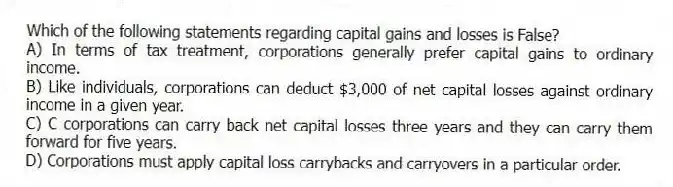

Which of the following statements regarding capital gains and losses is False?

A) In terms of tax treatment, corporations generally prefer capital gains to ordinary income.

B) Like individuals, corporations can deduct $3,000 of net capital losses against ordinary income in a given year.

C) C corporations can carry back net capital losses three years and they can carry them forward for five years.

D) Corporations must apply capital loss carrybacks and carryovers in a particular order.

Correct Answer:

Verified

Q67: In January 2017, Khors Company issued nonqualified

Q68: Canny Foods Co. is considering three ways

Q69: For corporations, which of the following regarding

Q72: Which of the following statements regarding net

Q73: Orange Inc. issued 20,000 nonqualified stock options

Q74: Which of the following statements regarding the

Q75: Which of the following statements regarding incentive

Q76: In January 2018, Khors Company issued nonqualified

Q86: Remsco has taxable income of $60,000 and

Q90: Studios reported a net capital loss of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents