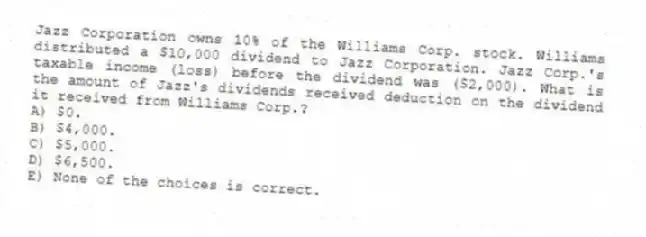

Jazz Corporation owns 10% of the Williams Corp. stock. Williams distributed a $10,000 dividend to Jazz Corporation. Jazz Corp.'s taxable income (loss) before the dividend was ($2,000) . What is the amount of Jazz's dividends received deduction on the dividend it received from Williams Corp.?

A) $0.

B) $4,000.

C) $5,000.

D) $6,500.

E) None of the choices is correct.

Correct Answer:

Verified

Q70: BTW Corporation has taxable income in the

Q79: Which of the following is allowable as

Q81: Jazz Corporation owns 50% of the Williams

Q82: What is the unextended due date of

Q83: On January 1, 2017, GrowCo issued 50,000

Q85: In 2018, US Sys Corporation received $250,000

Q86: Jazz Corporation owns 10% of the Williams

Q87: Which of the following regarding Schedule M-1

Q88: Which of the following statements is False

Q89: In 2018, Carbonfab Manufacturers Inc. expensed $125,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents