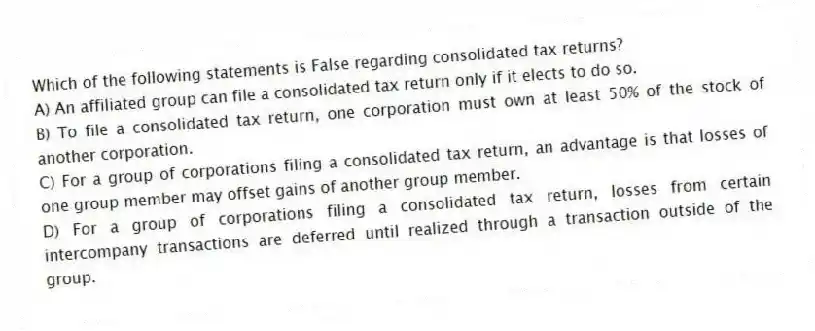

Which of the following statements is False regarding consolidated tax returns?

A) An affiliated group can file a consolidated tax return only if it elects to do so.

B) To file a consolidated tax return, one corporation must own at least 50% of the stock of another corporation.

C) For a group of corporations filing a consolidated tax return, an advantage is that losses of one group member may offset gains of another group member.

D) For a group of corporations filing a consolidated tax return, losses from certain intercompany transactions are deferred until realized through a transaction outside of the group.

Correct Answer:

Verified

Q83: On January 1, 2017, GrowCo issued 50,000

Q84: Jazz Corporation owns 10% of the Williams

Q85: In 2018, US Sys Corporation received $250,000

Q85: For book purposes, RadioAircast Inc. reported $15,000

Q86: Jazz Corporation owns 10% of the Williams

Q87: Which of the following regarding Schedule M-1

Q89: In 2018, Carbonfab Manufacturers Inc. expensed $125,000

Q90: For Corporation P to file a consolidated

Q91: On January 1, 2016, Credit Inc. recorded

Q93: Imperial Construction Inc. (IC) issued 100,000 incentive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents