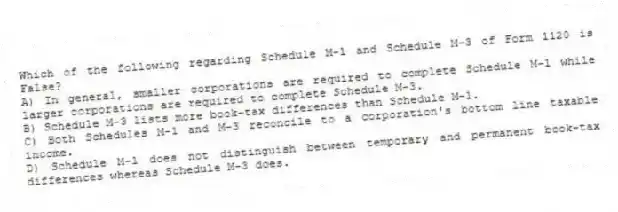

Which of the following regarding Schedule M-1 and Schedule M-3 of Form 1120 is False?

A) In general, smaller corporations are required to complete Schedule M-1 while larger corporations are required to complete Schedule M-3.

B) Schedule M-3 lists more book-tax differences than Schedule M-1.

C) Both Schedules M-1 and M-3 reconcile to a corporation's bottom line taxable income.

D) Schedule M-1 does not distinguish between temporary and permanent book-tax differences whereas Schedule M-3 does.

Correct Answer:

Verified

Q82: What is the unextended due date of

Q83: On January 1, 2017, GrowCo issued 50,000

Q84: Jazz Corporation owns 10% of the Williams

Q85: In 2018, US Sys Corporation received $250,000

Q85: For book purposes, RadioAircast Inc. reported $15,000

Q86: Jazz Corporation owns 10% of the Williams

Q88: Which of the following statements is False

Q89: In 2018, Carbonfab Manufacturers Inc. expensed $125,000

Q90: For Corporation P to file a consolidated

Q91: On January 1, 2016, Credit Inc. recorded

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents