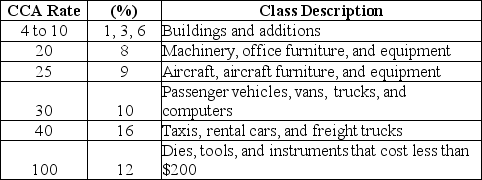

Sample CCA Rates and Classes are presented as follows:  What does the number "20" in the CCA Rate column mean?

What does the number "20" in the CCA Rate column mean?

A) A firm can claim a 20% depreciation rate per year for an asset such as machinery, office furniture, and equipment during its service life.

B) A firm can claim a 20% depreciation rate per year for an asset such as machinery, office furniture, and equipment beginning in the second half of the year after purchase of that asset.

C) A firm can fully depreciate an asset such as machinery, office furniture, and equipment in 5 years from the time it is purchased using the depreciation rate of 20% per year.

D) A firm can claim a 20% depreciation rate on half of the capital cost of a new asset such as machinery, office furniture and equipment in the year of purchase of that asset, while the other half is included in the following year.

E) A firm can only depreciate an asset such as machinery, office furniture, and equipment with the rate of 20% in the first year of purchase of that asset.

Correct Answer:

Verified

Q7: GEMTECH Ltd. is an engineering construction company.

Q8: Why do businesses want to depreciate their

Q9: A company purchased a piece of equipment

Q10: The capital tax factor (CTF)is a value

Q11: SHMON Inc. wants to invest in future

Q13: SINCO Ltd. purchased a piece of equipment

Q14: The salvage value of a ten-year-old truck

Q15: The effect of taxation on annual savings

Q16: A firm has just purchased a vehicle

Q17: Sirius Ltd. purchased a piece of equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents