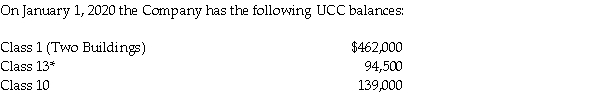

For its taxation year ending December 31, 2020, Axel Ltd. has determined that its Net Income For Tax Purposes, before any deductions for CCA, amounts to $42,000. The Company does not have any Division C deductions, so whatever amount is determined as Net Income For Tax Purposes will also be the amount of Taxable Income for the 2020 taxation year.  *This balance reflects leasehold improvements made on January 1, 2018 at a total cost of $126,000. The original term of the lease was 4 years. However, there are two available renewal options, each allowing Axel Ltd. to renew for a period of two years.

*This balance reflects leasehold improvements made on January 1, 2018 at a total cost of $126,000. The original term of the lease was 4 years. However, there are two available renewal options, each allowing Axel Ltd. to renew for a period of two years.

During 2020, the cost of additions to Class 10 amounted to $76,000, while the proceeds from dispositions in this class totalled $58,000. In no case did the proceeds of disposition exceed the capital cost of the assets disposed of, and there were still assets in the class as of December 31, 2020.

There were no acquisitions or dispositions in either Class 1 or Class 8 during 2020. However, Axel has received an unsolicited offer to purchase one of its buildings which it is considering.

Required:

A. Calculate the maximum CCA that could be taken by Axel Ltd. for the taxation year ending December 31, 2020. Your answer should include the maximum that can be deducted for each CCA class.

B. As Axel's tax advisor, indicate how much CCA you would advise them to take for the 2020 taxation year and the specific classes from which it should be deducted. Provide a brief explanation of the reason for your recommendation. In providing this advice, do not take into consideration the possibility that losses can be carried either back or forward.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: At the beginning of 2020, Quest Inc.

Q86: Multilink Inc. has a December 31 year

Q87: The following information relates to Andorn Ltd.

Q88: For its taxation year ending December 31,

Q89: The following information relates to the Fortin

Q90: Votex Inc. closes its books on December

Q91: Farine Ltd. has a taxation year which

Q92: Shawarma Palace Ltd. was incorporated on January

Q93: Ken's Kouriers is an unincorporated business which

Q94: Sherd Inc. disposes of a Class 8

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents