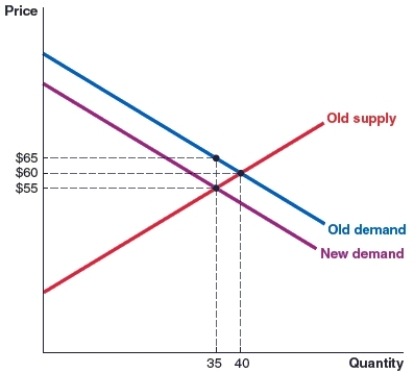

(Figure: Tax on Buyer) Refer to the graph which shows a tax on a buyer. Using the graph, answer the following questions:

(i) What was the equilibrium price before the implementation of the tax?

(i) What was the equilibrium price before the implementation of the tax?

(ii) What price do buyers pay after the implementation of the tax?

(iii) What price do sellers get after the implementation of the tax?

(iv) What was the equilibrium quantity (in units) before the implementation of the tax?

(v) What is the new equilibrium quantity (in units) after the implementation of the tax?

(vi) The amount of the tax is $_______ per unit of the item.

(vii) The economic burden of the tax on the buyer is $_______ per unit of the item.

(viii) The economic burden of the tax on the seller is $_______ per unit of the item.

Correct Answer:

Verified

Q102: Which of the following statements is correct?

A)When

Q103: Which of the following statements is correct?

A)The

Q104: (Figure: Market for Plastic Containers) The figure

Q105: This question has two parts:

(a) What is

Q106: (Figure: Tax on Seller) Refer to the

Q108: Fill in the blanks below using one

Q109: (Figure: Sugar Market) Refer to the graph

Q110: The table shows the market for

Q111: The table shows market data for

Q112: (Figure: Quota) Refer to the graph which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents