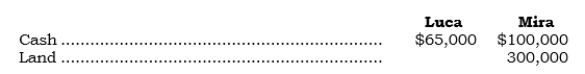

_____ Luca and Mira formed a partnership on 7/1/06 and contributed the following assets. The realty was subject to a mortgage of $25,000, which was assumed by the partnership. The partnership agreement provides that Luca and Mira will share profits and losses in the ratio of one-third and two-thirds, respectively. Mira's capital account at 7/1/06 should be

The realty was subject to a mortgage of $25,000, which was assumed by the partnership. The partnership agreement provides that Luca and Mira will share profits and losses in the ratio of one-third and two-thirds, respectively. Mira's capital account at 7/1/06 should be

A) $400,000

B) $391,667

C) $375,000

D) $310,000

E) None of the above.

Correct Answer:

Verified

Q25: _ A partner's drawing account, in substance,

Q26: _ Under the Revised Uniform Partnership Act,

A)

Q27: _ A distinct and major advantage of

Q28: _ A partnership is formed by two

Q29: _ Cody and Paul formed a partnership

Q31: _ On 7/1/06, Burr and Lapp formed

Q32: _ On 7/1/06, Pane and Sills formed

Q33: _ The partnership agreement of Jones, King,

Q34: The partnership agreement for the partnership of

Q35: From a tax perspective, a partner's interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents