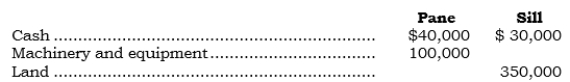

_____ On 7/1/06, Pane and Sills formed a partnership, and each contributed assets with agreed-upon values as follows: The building is subject to a mortgage loan of $100,000, which is to be assumed by the partnership. The agreed-upon value of the building is $50,000 more than its tax basis of $300,000. The partnership agreement provides that Pane and Sills share profits and losses 60% and 40%, respectively.

The building is subject to a mortgage loan of $100,000, which is to be assumed by the partnership. The agreed-upon value of the building is $50,000 more than its tax basis of $300,000. The partnership agreement provides that Pane and Sills share profits and losses 60% and 40%, respectively.

Using this information, on 7/1/06, the balance in Sills's capital account should be

A) $380,000

B) $330,000

C) $300,000

D) $280,000

E) None of the above.

Correct Answer:

Verified

Q27: _ A distinct and major advantage of

Q28: _ A partnership is formed by two

Q29: _ Cody and Paul formed a partnership

Q30: _ Luca and Mira formed a partnership

Q31: _ On 7/1/06, Burr and Lapp formed

Q33: _ The partnership agreement of Jones, King,

Q34: The partnership agreement for the partnership of

Q35: From a tax perspective, a partner's interest

Q36: Income tax laws concerning partnerships are centered

Q37: For income tax-reporting purposes, a partner's _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents