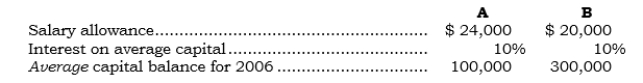

The partnership agreement for the partnership of A and B provides for the division of profits in the following manner:

a. For salary allowances--but only to the extent available.

b. For imputed interest on capital--but only to the extent available.

c. For any remaining profit in the profit and loss sharing ratio of 3:2.

For 2006, the profit before salary allowances and imputed interest was $60,000. Other data follow:

Required:

Required:

Calculate the division of profits for 2006.

Correct Answer:

Verified

Q29: _ Cody and Paul formed a partnership

Q30: _ Luca and Mira formed a partnership

Q31: _ On 7/1/06, Burr and Lapp formed

Q32: _ On 7/1/06, Pane and Sills formed

Q33: _ The partnership agreement of Jones, King,

Q35: From a tax perspective, a partner's interest

Q36: Income tax laws concerning partnerships are centered

Q37: For income tax-reporting purposes, a partner's _

Q38: Income tax laws pertaining to partnerships are

Q39: For tax purposes, a partner's interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents