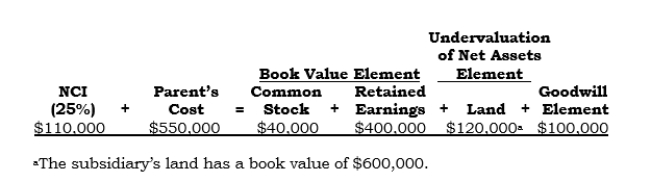

On 5/1/06, Pozco acquired 75% of Sozco's outstanding common stock for $550,000 cash. (On 4/30/06, Sozco's assets and liabilities had book values of $2,000,000 and $1,560,000 respectively.) A conceptual analysis of the Invest-ment account as of 5/1/06 under the parent company concept follows:

Required:

a. Determine the amounts at which the land and goodwill would be reported in the consolidated financial statements under the parent company concept.

a. Determine the amounts at which the land and goodwill would be reported in the consolidated financial statements under the parent company concept.

b. Determine the amounts at which the land and goodwill would be reported in the consolidated financial statements under the economic unit concept.

c. Determine the dollar amount differences between the noncontrolling interest reported in the balance sheet under the parent company concept versus under the economic unit concept.

Correct Answer:

Verified

Q64: COMPREHENSIVE

On 7/1/06, PBM Company acquired 100% of

Q65: On 9/1/06, Panco acquired 80% of Sanco's

Q66: On 4/1/06, Parrco acquired 60% of Subbco's

Q67: Pyna acquired 75% of Syna's outstanding common

Q68: Pimex acquired 80% of Simex's outstanding common

Q70: On 6/1/06, Phota acquired 90% of Shota's

Q71: Penco acquired 60% of Senco's outstanding common

Q72: Punda purchased two blocks of stock of

Q73: On 7/1/06, PDQ acquired 80% of Sprint's

Q74: At a postacquisition impairment evaluation date, the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents