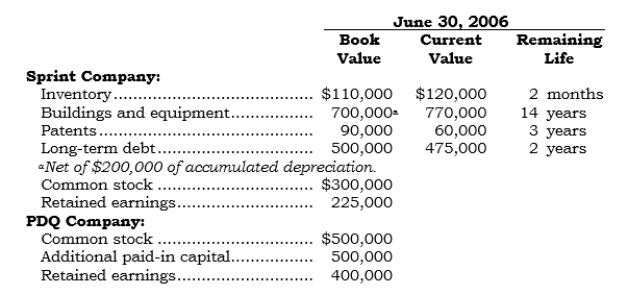

On 7/1/06, PDQ acquired 80% of Sprint's outstanding common stock by issuing 8,000 shares of its $5 par value common stock (which was trading at $60 per share on that date). In addition, PDQ incurred direct costs of $100,000 relating to the acquisition, $60,000 of which was for the registration of the shares issued with the SEC. Selected relevant data follow:

Additional Information:

Additional Information:

Additional Information:

a. The non-push-down basis of accounting was selected.

b. The equity method of accounting is to be used.

c. During 2006, PDQ declared and paid $80,000 of dividends each quarter. Also, PDQ reported a net income of $200,000 for the 6 months ended 6/30/06.

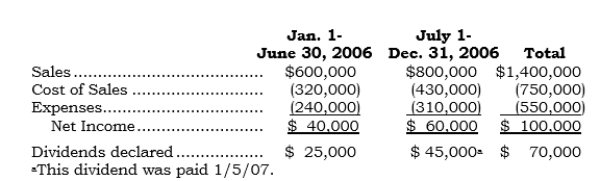

d. For 2006, Sprint had the following earnings and dividends:

Required:

Required:

a. Prepare the entry to record the business combination on 7/1/06.

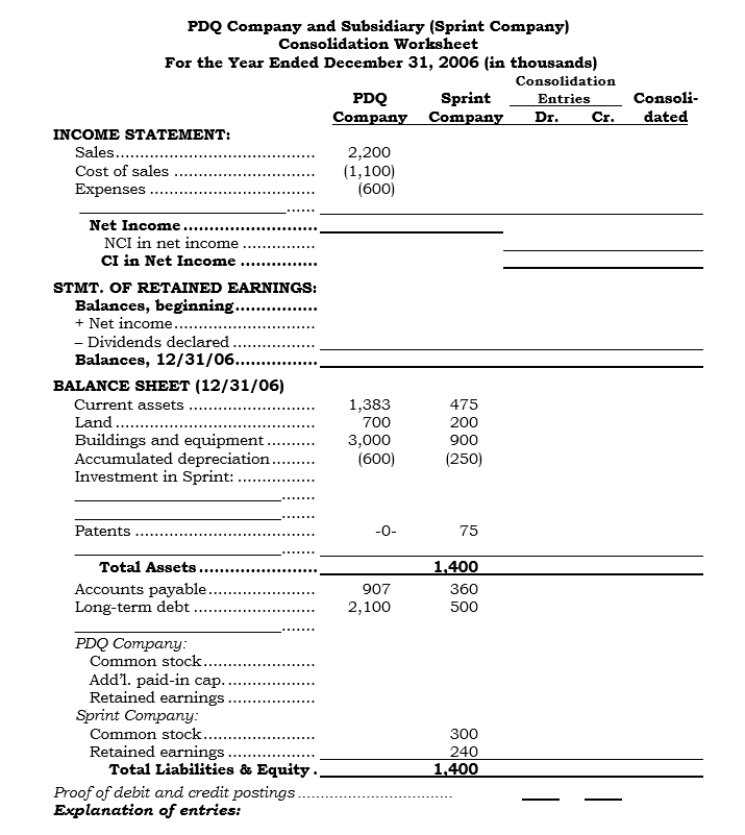

b. Complete the PDQ and Sprint Company columns of the following consolidation worksheet.

c. Prepare all the consolidation entries.

d. Post the consolidation entries in Requirement c to the consolidation worksheet and complete the worksheet.

Correct Answer:

Verified

Q64: COMPREHENSIVE

On 7/1/06, PBM Company acquired 100% of

Q65: On 9/1/06, Panco acquired 80% of Sanco's

Q66: On 4/1/06, Parrco acquired 60% of Subbco's

Q67: Pyna acquired 75% of Syna's outstanding common

Q68: Pimex acquired 80% of Simex's outstanding common

Q69: On 5/1/06, Pozco acquired 75% of Sozco's

Q70: On 6/1/06, Phota acquired 90% of Shota's

Q71: Penco acquired 60% of Senco's outstanding common

Q72: Punda purchased two blocks of stock of

Q74: At a postacquisition impairment evaluation date, the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents