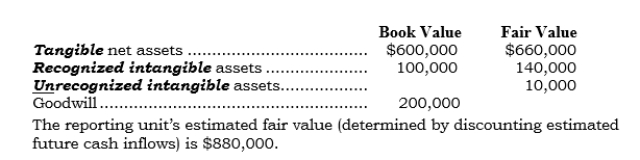

At a postacquisition impairment evaluation date, the following information exists for an acquired subsidiary that is a reporting unit:

Required

Required

a. What is the implied fair value of goodwill?

b. What is the impairment loss to be recognized, if any?

c. Prepare the parent's appropriate adjusting entry, if necessary. (Assume that the parent had acquired common stock and used non-push-down accounting.)

d. If an impairment evaluation is performed one year later and the goodwill's implied fair value is $200,000 at that date, what adjusting entry would be made by the parent?

Correct Answer:

Verified

Q64: COMPREHENSIVE

On 7/1/06, PBM Company acquired 100% of

Q65: On 9/1/06, Panco acquired 80% of Sanco's

Q66: On 4/1/06, Parrco acquired 60% of Subbco's

Q67: Pyna acquired 75% of Syna's outstanding common

Q68: Pimex acquired 80% of Simex's outstanding common

Q69: On 5/1/06, Pozco acquired 75% of Sozco's

Q70: On 6/1/06, Phota acquired 90% of Shota's

Q71: Penco acquired 60% of Senco's outstanding common

Q72: Punda purchased two blocks of stock of

Q73: On 7/1/06, PDQ acquired 80% of Sprint's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents