The following is from the footnotes to The Coca-Cola Company's recent financial statements. (Note: Coca-Cola's 2016 disclosures are consistent with the former accounting rules for marketable equity securities.)

Trading Securities

As of December 31, 2016 and 2015, our trading securities had a fair value of $384 million and $322 million, respectively, and consisted primarily of equity securities. The Company had net unrealized gains on trading securities of $39 million, $19 million and $40 million as of December 31, 2016, 2015 and 2014, respectively. The Company's trading securities were included in the following line items in our consolidated balance sheets (in millions):

Available-for-Sale and Held-to-Maturity Securities

Available-for-Sale and Held-to-Maturity Securities

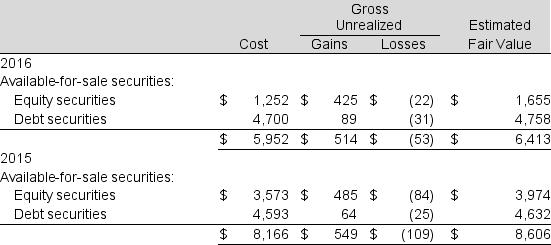

As of December 31, 2016 and 2015, the Company did not have any held-to-maturity securities. Available-for-sale securities consisted of the following (in millions):

In 2016 and 2015, the Company did not have any held-to-maturity securities. The Company's available-for-sale securities were included in the following captions in our consolidated balance sheets (in millions):

In 2016 and 2015, the Company did not have any held-to-maturity securities. The Company's available-for-sale securities were included in the following captions in our consolidated balance sheets (in millions):

Continued next page

Continued next page

Required:

a. Explain the difference between "Held-to-maturity securities," "Available-for-sale securities," and "Trading securities."

b. What amount does The Coca-Cola Company report for available-for-sale securities on its balance sheets at December 31, 2016, and 2015? How are these values measured?

c. What are the net unrealized gains (losses) on available-for-sale securities for 2016 and 2015?

d. How did these unrealized gains (losses) on available-for-sale securities affect the company's reported income in 2016?

e. What is the difference between realized and unrealized gains and losses? Are realized gains and losses treated differently in the income statement than unrealized gains and losses? Under new accounting rules that take effect in 2018, how does the treatment of unrealized gains and losses differ?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: Maryhill Corp. purchased all of Hood River

Q59: Sanfran, Inc. decided to split off its

Q60: Kadoka, Inc. has an investment on its

Q61: The 2016 annual report of Bank of

Q62: Following is a portion of the investments

Q64: Following is a portion of the investments

Q65: Waste Management Inc. reports the following in

Q66: The 2016 income statement of Salem Company

Q67: The following information comes from the 2016

Q68: Camire Corp. acquired 100% of the common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents