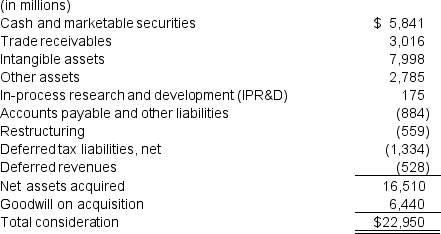

Camire Corp. acquired 100% of the common stock of Koontz Technologies, Inc. The purchase price for Koontz was $22,950 million and was allocated as follows:

a. What method of accounting did Camire use to account for this acquisition?

b. What amount(s) will be recorded in the investment account of Camire's balance sheet for the Koontz Technologies acquisition?

c. Are the intangible assets purchased in the Koontz Technologies acquisition, reported on Camire's consolidated balance sheet at book value or at fair value on the date of the acquisition? Explain.

d. How will the intangible assets account balance change on the consolidated balance sheet in subsequent years?

e. How will the recognition of goodwill affect Camire's consolidated balance sheet? How will this asset change in subsequent years?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: The following is from the footnotes to

Q64: Following is a portion of the investments

Q65: Waste Management Inc. reports the following in

Q66: The 2016 income statement of Salem Company

Q67: The following information comes from the 2016

Q69: Urbana Coffee Company reported the following in

Q70: What are the various methods used to

Q71: How does the equity-method of accounting for

Q72: What steps are taken to allocate the

Q73: Why is goodwill not amortized? When is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents