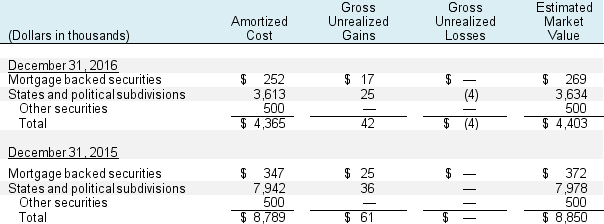

Following is a portion of the investments footnote from the 2016 10-K report of Bancfirst Corporation (in thousands), related to held-to-maturity securities.

The following table summarizes the amortized cost and estimated market values of securities held for investment:

Required:

Required:

a. What amount does Bancfirst report on its balance sheet at December 31, 2016, for these held-to-maturity securities?

b. Calculate the unrealized gains or losses on these securities at December 31, 2016. How do these unrealized gains or losses affect the 2016 balance sheet and the 2016 income statement?

c. If these held-to-maturity securities had instead been classified as available-for sale, how would Bancfirst's 2016 balance sheet and income statement been different?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q59: Sanfran, Inc. decided to split off its

Q60: Kadoka, Inc. has an investment on its

Q61: The 2016 annual report of Bank of

Q62: Following is a portion of the investments

Q63: The following is from the footnotes to

Q65: Waste Management Inc. reports the following in

Q66: The 2016 income statement of Salem Company

Q67: The following information comes from the 2016

Q68: Camire Corp. acquired 100% of the common

Q69: Urbana Coffee Company reported the following in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents