Urbana Coffee Company reported the following in its 2017 annual report.

On September 20, 2017, we completed the spin-off of Champaign Tea, Inc. to shareowners of Urbana Coffee. Urbana Coffee distributed a dividend of two shares of Champaign Tea common stock for every 25 shares of Urbana Coffee common stock. Cash was paid for fractional shares. The distribution of Champaign Tea common stock is considered a tax-free transaction for us and for our shareowners, except for the cash payments for fractional shares, which are generally taxable.

We recorded pretax charges of $150 million ($108 million after-tax, or $0.07 per diluted share) for costs related to the spin-off of Champaign Tea. These costs primarily consisted of banking and legal fees, as well as filing fees, printing and mailing costs.

Required:

a. Explain the accounting for spin-offs.

b. How did the spin-off affect Urbana Coffee's net income in 2017?

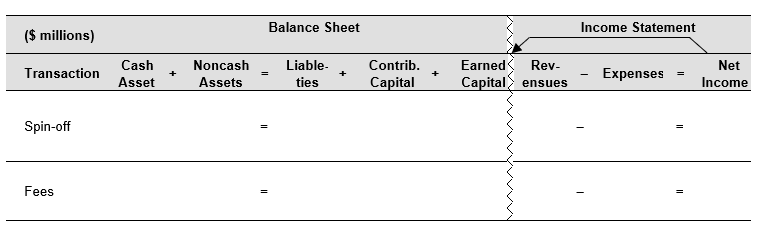

c. Use the financial statements effect template, below, to show the spin-off effects on Urbana Coffee's financial statements. Assume the book value of Champaign Tea was $7,200 million.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Following is a portion of the investments

Q65: Waste Management Inc. reports the following in

Q66: The 2016 income statement of Salem Company

Q67: The following information comes from the 2016

Q68: Camire Corp. acquired 100% of the common

Q70: What are the various methods used to

Q71: How does the equity-method of accounting for

Q72: What steps are taken to allocate the

Q73: Why is goodwill not amortized? When is

Q74: Why would a corporate manager decide to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents