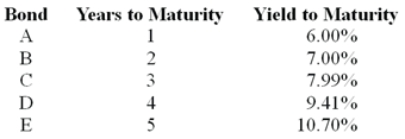

Consider the following $1 000 par value zero-coupon bonds: The expected one-year interest rate four years from now should be ________.

The expected one-year interest rate four years from now should be ________.

A) 16.00%

B) 18.00%

C) 20.00%

D) 22.00%

Correct Answer:

Verified

Q1: You would typically find all but which

Q2: The _ of a bond is computed

Q3: Consider the following $1 000 par value

Q5: Consider a newly issued TIPS bond with

Q6: An investor pays $989.40 for a bond.

Q7: Growth shares usually exhibit _ price-to-book ratios

Q8: You run a regression of a share's

Q9: If the simple CAPM is valid and

Q10: What is the expected return on a

Q11: There are two independent economic factors M1

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents