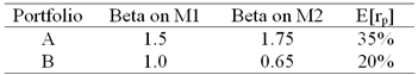

There are two independent economic factors M1 and M2. The risk-free rate is 5% and all shares have independent firm-specific components with a standard deviation of 25%. Portfolios A and B are well diversified. Given the data below which equation provides the correct pricing model?

A) E(rP) = 5 + 1.12?P1 + 11.86?P2

B) E(rP) = 5 + 4.96?P1 + 13.26?P2

C) E(rP) = 5 + 3.23?P1 + 8.46?P2

D) E(rP) = 5 + 8.71?P1 + 9.68?P2

Correct Answer:

Verified

Q1: You would typically find all but which

Q2: The _ of a bond is computed

Q3: Consider the following $1 000 par value

Q4: Consider the following $1 000 par value

Q5: Consider a newly issued TIPS bond with

Q6: An investor pays $989.40 for a bond.

Q7: Growth shares usually exhibit _ price-to-book ratios

Q8: You run a regression of a share's

Q9: If the simple CAPM is valid and

Q10: What is the expected return on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents