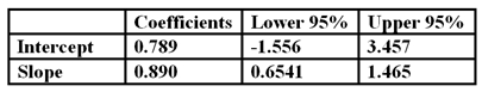

You run a regression of a share's returns versus a market index and find the following: Based on the data you know that the share

A) earned a positive alpha that is statistically significantly different from zero

B) has a beta precisely equal to 0.890

C) has a beta that could be anything between 0.6541 and 1.465 inclusive

D) has no systematic risk

Correct Answer:

Verified

Q1: You would typically find all but which

Q2: The _ of a bond is computed

Q3: Consider the following $1 000 par value

Q4: Consider the following $1 000 par value

Q5: Consider a newly issued TIPS bond with

Q6: An investor pays $989.40 for a bond.

Q7: Growth shares usually exhibit _ price-to-book ratios

Q9: If the simple CAPM is valid and

Q10: What is the expected return on a

Q11: There are two independent economic factors M1

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents