Torro's Construction Company Wants to Expand Its Operations The 130G Will Provide a Consistent Annual Operating Cash Inflow

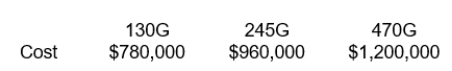

Torro's construction company wants to expand its operations. To do this, the company will need to purchase a new excavator. There are several possible options for the new purchase. All options will have a 10-year life with no salvage value. The company has a 21% tax rate and a cost of capital of 9%. The following options have been provided.

The 130G will provide a consistent annual operating cash inflow of $110,000 per year for the 10 years.

The 130G will provide a consistent annual operating cash inflow of $110,000 per year for the 10 years.

The 245G will provide annual operating cash inflows for years 1 and 2 of $170,000. Years 3 - 7 will drop to $130,000 per year, and years 8 - 10 will drop to $90,000 per year.

The 470G will have no cash flows in year 1, $170,000 in years 2 - 8, and $220,000 in year years 9 and 10.

Instructions

a. Calculate the simple payback period for each option.

b. If Torro's will only accept investments with a payback period of 8 years or less, would any of the options work for the company?

c. What are the total cash flows for each of the options over the 10-year life? Are these amounts taken into consideration when using the payback period?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Perry Inc purchased three companies last year.

Q103: Venus just won $23,150,000 in the Powerball.

Q104: Reyes Consulting is considering an investment in

Q105: Artful Crossing Services is considering three new

Q106: Luis is a CPA and manages several

Q108: WhiteCare Dry Cleaning has decided they need

Q109: You and your spouse are not on

Q110: InterCo Systems and Services is going green.

Q111: You have decided you're tired of working

Q112: Alexys, Justys, and Skylar are competing for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents