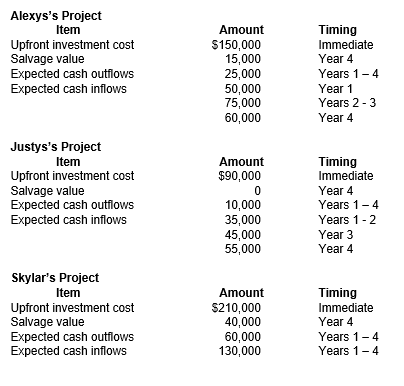

Alexys, Justys, and Skylar are competing for a job as CEO of Athletic Angels, Inc. As part of the hiring process, they have been charged with choosing a suitable investment for the company that will bring in more student-athletes. The current board of directors has asked them to keep the proposal within a 4-year time frame. The minimum rate of return the company will accept is 10%, and its corporate tax rate is 21%. As outgoing CEO, you need to evaluate the three proposals and recommend one to the board of directors. Information for the three projects are as follows:

Instructions

Instructions

a. For each of the three investments, calculate the

1) NPV.

2) IRR (using Excel).

3) ARR.

4) Profitability Index.

b. Rank the projects from most desirable to least desirable. Are there any proposals that should be immediately disregarded? Why?

c. Which proposal would you suggest to the board of directors?

d. Would your suggestion change if Skylar's proposal had estimated outflows per year of $70,000? Recalculate the NPV, IRR, ARR, and profitability index to prove your answer.

e. For the proposal suggested in part c, calculate the project's breakeven before-tax and after-tax cash flows that will provide an NPV of zero.

f. How much can the proposal you chose in part c be off and still be a reliable investment?

g. If Justys's proposal was chosen and year 1's data showed Cash outflow of $12,000 and cash inflow of $44,000, recalculate the NPV and IRR using years 1's numbers is they are expected to continue for the next three years. Was this a good investment choice, and should the project continue for the additional 3 years?

Correct Answer:

Verified

1. $(18,127)

2. 4.73%

3. 3.2...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Perry Inc purchased three companies last year.

Q103: Venus just won $23,150,000 in the Powerball.

Q104: Reyes Consulting is considering an investment in

Q105: Artful Crossing Services is considering three new

Q106: Luis is a CPA and manages several

Q107: Torro's construction company wants to expand

Q108: WhiteCare Dry Cleaning has decided they need

Q109: You and your spouse are not on

Q110: InterCo Systems and Services is going green.

Q111: You have decided you're tired of working

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents