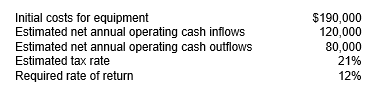

You have decided you're tired of working for someone else and would like to start up a business venture. You've applied to Shark Tank for investment but were turned down. You think the best fit for you is a fitness center, where you will be a personal trainer, sell nutrition supplements and sell a clothing line. You will need to find a location for your business, hire employees, buy equipment, and consider all of the other overhead items you will need to run your business. Following is the information you have obtained so far:

You would like to run the fitness center for 10 years and then decide to sell or continue the operations. (Note, depreciation will be calculated on the estimated 10-year life)

You would like to run the fitness center for 10 years and then decide to sell or continue the operations. (Note, depreciation will be calculated on the estimated 10-year life)

Instructions

a. Calculate the following

1. NPV

2. simple payback

3. IRR (using excel)

4. ARR

5. profitability index

b. Should you invest in this new business venture?

c. What is the project's breakeven before-tax and after-tax cash flows that will provide an NPV of zero?

d. What are the project's current net before-tax and after-tax operating cash flows?

e. How much can you be off on your cash flow estimates and still have the business survive?

f. What does part e tell you about your estimated before-tax cash flows?

Correct Answer:

Verified

2. 4.75 years

3. 13.41%

4. ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Perry Inc purchased three companies last year.

Q103: Venus just won $23,150,000 in the Powerball.

Q104: Reyes Consulting is considering an investment in

Q105: Artful Crossing Services is considering three new

Q106: Luis is a CPA and manages several

Q107: Torro's construction company wants to expand

Q108: WhiteCare Dry Cleaning has decided they need

Q109: You and your spouse are not on

Q110: InterCo Systems and Services is going green.

Q112: Alexys, Justys, and Skylar are competing for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents