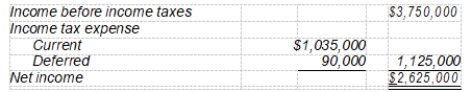

Markes Corporation's partial income statement after its first year of operations is as follows: Markes uses the straight -line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The amount charged to depreciation expense on its books this year was $1,500,000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?

Markes uses the straight -line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The amount charged to depreciation expense on its books this year was $1,500,000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?

A) $1,200,000

B) $1,425,000

C) $1,500,000

D) $1,800,000

Correct Answer:

Verified

Q35: Hefner Co. at the end of 2008,

Q36: Hefner Co. at the end of 2008,

Q37: Frizell Co. at the end of 2007,

Q38: Frizell Co. at the end of 2007,

Q39: Frizell Co. at the end of

Q41: Dwyer Company reported the following results for

Q42: In 2008, Admire Company accrued, for financial

Q43: Gleim Inc. has a deductible temporary

Q44: O'Malley Corporation prepared the following reconciliation for

Q45: O'Malley Corporation prepared the following reconciliation for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents