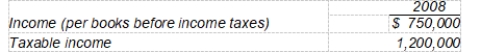

Dwyer Company reported the following results for the year ended December 31, 2008, its first year of operations: The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2009. What should Dwyer record as a net deferred tax asset or liability for the year ended December 31, 2008, assuming that the enacted tax rates in effect are 40% in 2008 and 35% in 2009?

The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2009. What should Dwyer record as a net deferred tax asset or liability for the year ended December 31, 2008, assuming that the enacted tax rates in effect are 40% in 2008 and 35% in 2009?

A) $180,000 deferred tax liability

B) $157,500 deferred tax asset

C) $180,000 deferred tax asset

D) $157,500 deferred tax liability

Correct Answer:

Verified

Q36: Hefner Co. at the end of 2008,

Q37: Frizell Co. at the end of 2007,

Q38: Frizell Co. at the end of 2007,

Q39: Frizell Co. at the end of

Q40: Markes Corporation's partial income statement after its

Q42: In 2008, Admire Company accrued, for financial

Q43: Gleim Inc. has a deductible temporary

Q44: O'Malley Corporation prepared the following reconciliation for

Q45: O'Malley Corporation prepared the following reconciliation for

Q46: Jesse Company sells household furniture. Customers who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents