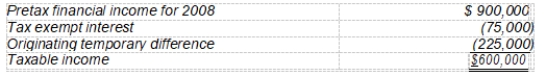

O'Malley Corporation prepared the following reconciliation for its first year of operations:

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2008 is 35%.

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%. The enacted tax rate for 2008 is 35%.

-In O'Malley's 2008 income statement, what amount should be reported for total income tax expense?

A) $330,000

B) $315,000

C) $300,000

D) $210,000

Correct Answer:

Verified

Q40: Markes Corporation's partial income statement after its

Q41: Dwyer Company reported the following results for

Q42: In 2008, Admire Company accrued, for financial

Q43: Gleim Inc. has a deductible temporary

Q44: O'Malley Corporation prepared the following reconciliation for

Q46: Jesse Company sells household furniture. Customers who

Q47: McGee Company deducts insurance expense of $84,000

Q48: McGee Company deducts insurance expense of $84,000

Q49: McGee Company deducts insurance expense of $84,000

Q50: Tyler Company made the following journal entry

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents