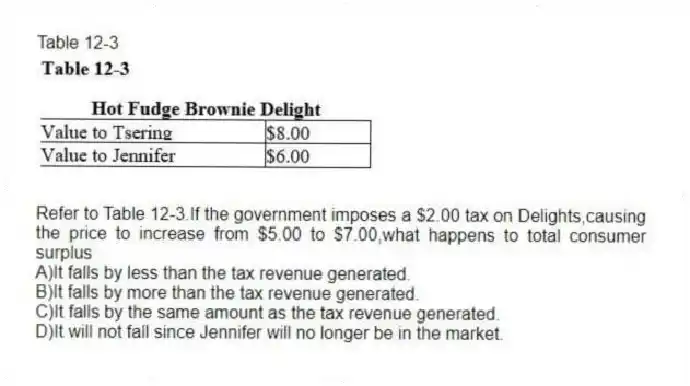

Table 12-3

-Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,what happens to total consumer surplus

A) It falls by less than the tax revenue generated.

B) It falls by more than the tax revenue generated.

C) It falls by the same amount as the tax revenue generated.

D) It will not fall since Jennifer will no longer be in the market.

Correct Answer:

Verified

Q64: How is a tax system best defined

Q65: Which of the following is an effect

Q66: Table 12-3 Q67: Scenario 12-1 Q68: When do taxes create deadweight loss Q70: What results when taxes are imposed on Q71: Scenario 12-1 Q72: Scenario 12-1 Q73: What kind of taxes are deadweight losses Q74: Table 12-3

![]()

Suppose Jeremy and Kelsey receive great

A)when they

Suppose Jeremy and Kelsey receive great

Suppose Jeremy and Kelsey receive great

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents