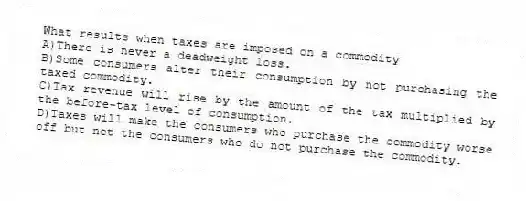

What results when taxes are imposed on a commodity

A) There is never a deadweight loss.

B) Some consumers alter their consumption by not purchasing the taxed commodity.

C) Tax revenue will rise by the amount of the tax multiplied by the before-tax level of consumption.

D) Taxes will make the consumers who purchase the commodity worse off but not the consumers who do not purchase the commodity.

Correct Answer:

Verified

Q65: Which of the following is an effect

Q66: Table 12-3 Q67: Scenario 12-1 Q68: When do taxes create deadweight loss Q69: Table 12-3 Q71: Scenario 12-1 Q72: Scenario 12-1 Q73: What kind of taxes are deadweight losses Q74: Table 12-3 Q75: What is part of the administrative burden Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

![]()

Suppose Jeremy and Kelsey receive great

A)when they

![]()

Suppose Jeremy and Kelsey receive great

Suppose Jeremy and Kelsey receive great

![]()