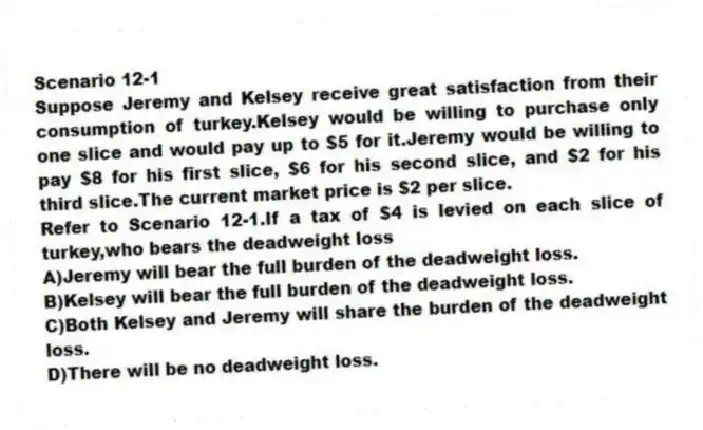

Scenario 12-1

Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice.

-Refer to Scenario 12-1.If a tax of $4 is levied on each slice of turkey,who bears the deadweight loss

A) Jeremy will bear the full burden of the deadweight loss.

B) Kelsey will bear the full burden of the deadweight loss.

C) Both Kelsey and Jeremy will share the burden of the deadweight loss.

D) There will be no deadweight loss.

Correct Answer:

Verified

Q66: Table 12-3 Q67: Scenario 12-1 Q68: When do taxes create deadweight loss Q69: Table 12-3 Q70: What results when taxes are imposed on Q72: Scenario 12-1 Q73: What kind of taxes are deadweight losses Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

![]()

Suppose Jeremy and Kelsey receive great

A)when they

![]()

Suppose Jeremy and Kelsey receive great