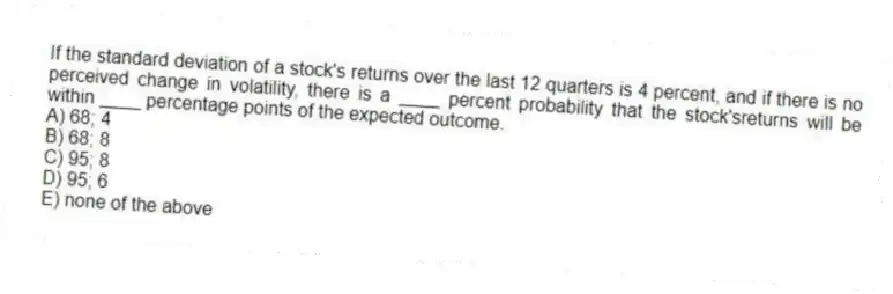

If the standard deviation of a stock's returns over the last 12 quarters is 4 percent, and if there is no perceived change in volatility, there is a ____ percent probability that the stock'sreturns will be within ____ percentage points of the expected outcome.

A) 68; 4

B) 68; 8

C) 95; 8

D) 95; 6

E) none of the above

Correct Answer:

Verified

Q45: If investors agree on a firm's forecasted

Q62: Portfolio managers who monitor systematic risk rather

Q65: Investors can avoid unsystematic risk by

A)using the

Q67: Which of the following is incorrect regarding

Q68: The limitations of the dividend discount model

Q69: The _ is not a measure of

Q71: The value-at-risk method is intended to warn

Q72: The U.S. government's budget deficit has a

Q73: Regarding the implied standard deviation, by plugging

Q87: The market risk premium is

A)the yield on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents