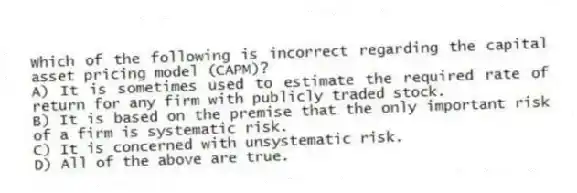

Which of the following is incorrect regarding the capital asset pricing model (CAPM) ?

A) It is sometimes used to estimate the required rate of return for any firm with publicly traded stock.

B) It is based on the premise that the only important risk of a firm is systematic risk.

C) It is concerned with unsystematic risk.

D) All of the above are true.

Correct Answer:

Verified

Q62: Portfolio managers who monitor systematic risk rather

Q65: If the standard deviation of a stock's

Q65: Investors can avoid unsystematic risk by

A)using the

Q68: The limitations of the dividend discount model

Q68: A portfolio's beta is the sum of

Q69: The _ is not a measure of

Q72: The U.S. government's budget deficit has a

Q73: Regarding the implied standard deviation, by plugging

Q79: Which of the following is not a

Q87: The market risk premium is

A)the yield on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents