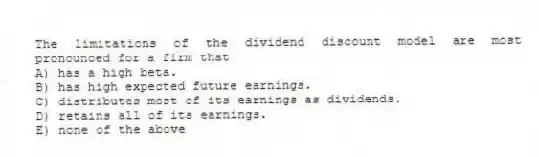

The limitations of the dividend discount model are most pronounced for a firm that

A) has a high beta.

B) has high expected future earnings.

C) distributes most of its earnings as dividends.

D) retains all of its earnings.

E) none of the above

Correct Answer:

Verified

Q61: Regarding the value-at-risk method, the same methods

Q62: Portfolio managers who monitor systematic risk rather

Q65: If the standard deviation of a stock's

Q65: Investors can avoid unsystematic risk by

A)using the

Q67: Which of the following is incorrect regarding

Q68: A portfolio's beta is the sum of

Q69: The _ is not a measure of

Q72: The U.S. government's budget deficit has a

Q73: Regarding the implied standard deviation, by plugging

Q79: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents