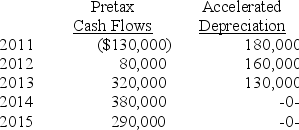

Late in 2010,the Spencer K Corporation has projected the pretax cash flows shown below for a dabblemaster that cost $460,000.If Spencer K Corp's tax rate is 40% and its cost of capital is 14 percent.The projected cash flows and depreciation for the dabblemaster are described below.

Required:

Required:

(A.)Calculate the net present value of the dabblemaster given the pretax cash flows and depreciation described above and indicate whether you would recommend purchasing the assets.

(B.)If Spencer K Corp used straight-line depreciation of $94,000 per year for 5 years would your answer be the same?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: After computing a net present value that

Q68: What constitutes sensitivity analysis when using net

Q69: Explain why both the timing and quantity

Q70: Barton Inc had assets of $15,350,000 and

Q71: At the end of 2010,Bezdek Corporation is

Q73: Weimer Systems,Inc.is considering the purchase of a

Q74: Gfeller Brothers had earnings before interest of

Q75: The Katrina Corp is considering the purchase

Q76: Champion Contractors had earnings before interest of

Q77: Huntel Systems,Inc.is considering the purchase of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents