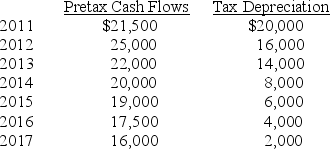

At the end of 2010,Bezdek Corporation is planning to buy a new machine for $70,000 The new machine has a useful life of 7 years and is expected to have a salvage value of $5,000.The pretax cash flow and the depreciation for tax purposes are described below.Bezdek's tax rate is 30 percent and its cost of capital is 15 percent.

Required:

Required:

(A.)Calculate the net present value for the new machine.

(B.)Should Bezdek but the new machine?

Correct Answer:

Verified

Year After-Tax Cash Inflow T...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: Standard Corporation is considering the purchase of

Q67: After computing a net present value that

Q68: What constitutes sensitivity analysis when using net

Q69: Explain why both the timing and quantity

Q70: Barton Inc had assets of $15,350,000 and

Q72: Late in 2010,the Spencer K Corporation has

Q73: Weimer Systems,Inc.is considering the purchase of a

Q74: Gfeller Brothers had earnings before interest of

Q75: The Katrina Corp is considering the purchase

Q76: Champion Contractors had earnings before interest of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents