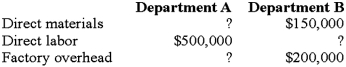

Harrison allocates factory overhead on the basis of direct labor cost. The overhead rates for the year are 50% for Department A and 100% for Department  The total manufacturing costs assigned to job M15 during May were $1,400,000.

The total manufacturing costs assigned to job M15 during May were $1,400,000.

Required:

Calculate the missing (?) costs (Department A direct materials and factory overhead and Department B direct labor).

Correct Answer:

Verified

Feedback: Department A f...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Job costing in service industries uses recording

Q102: Boston Manufacturing Company had the following cost

Q103: LM Company listed the following data for

Q104: Rivera Company manufactured two products, A and

Q105: Manufacturers of large equipment such as aircraft

Q106: Jones and Jones CPA firm has the

Q107: Riverside Company manufactures two sizes of T-shirts,

Q109: Catlett Company manufactures products to customer specifications.

Q111: Which method of accumulating product costs, job

Q117: Warren Company uses a predetermined overhead rate.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents