Riverside Company manufactures two sizes of T-shirts, medium and large. Both sizes go through cutting, assembling and finishing departments. The company uses operation costing.

Riverside Company's conversion costs applied to products for the month of June were: Cutting Department $60,000, Assembling Department $60,000, and Finishing Department $30,000. June had no beginning or ending work-in-process inventory.

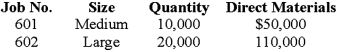

The quantities and direct materials costs for June follow:  Each T-shirt, regardless of size, required the same cutting, assembling and finishing operations.

Each T-shirt, regardless of size, required the same cutting, assembling and finishing operations.

Required:

(1) Compute both unit cost and total cost for each shirt size produced in June.

(2) Prepare journal entries to record direct materials and conversion costs incurred in the three departments, and the finished goods costs for both shirt sizes.

Correct Answer:

Verified

Feedback: (1) The produc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Boston Manufacturing Company had the following cost

Q103: LM Company listed the following data for

Q104: Rivera Company manufactured two products, A and

Q105: Harrison allocates factory overhead on the basis

Q105: Manufacturers of large equipment such as aircraft

Q106: Jones and Jones CPA firm has the

Q109: Catlett Company manufactures products to customer specifications.

Q111: Which method of accumulating product costs, job

Q111: The following information is for Stier Company

Q112: Humming Company manufactures high quality musical instruments

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents