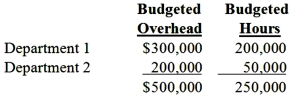

Rivera Company manufactured two products, A and B, during April. For purposes of product costing, an overhead rate of $2.00 per direct-labor hour was used, based on budgeted annual factory overhead of $500,000 and 250,000 budgeted annual direct-labor hours, as follows:  The number of labor hours required to manufacture each of these products was:

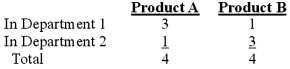

The number of labor hours required to manufacture each of these products was:  During April, production units for products A and B were 1,000 and 3,000, respectively.

During April, production units for products A and B were 1,000 and 3,000, respectively.

Required:

(1) Using a plantwide overhead rate, what are total overhead costs assigned to products A and B, respectively?

(2) Using departmental overhead rates, what are total overhead costs assigned to products A and B, respectively?

(3) Assume that materials and labor costs per unit of Product B are $10 and that the selling price is established by adding 40% of total costs to cover profit and selling and administrative expenses. What difference in selling price would result from the use of departmental overhead rates?

Correct Answer:

Verified

Feedback: (1) Using Plan...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Job costing in service industries uses recording

Q93: All of the following are examples of

Q102: Boston Manufacturing Company had the following cost

Q103: LM Company listed the following data for

Q105: Harrison allocates factory overhead on the basis

Q105: Manufacturers of large equipment such as aircraft

Q106: Jones and Jones CPA firm has the

Q107: Riverside Company manufactures two sizes of T-shirts,

Q109: Catlett Company manufactures products to customer specifications.

Q117: Warren Company uses a predetermined overhead rate.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents