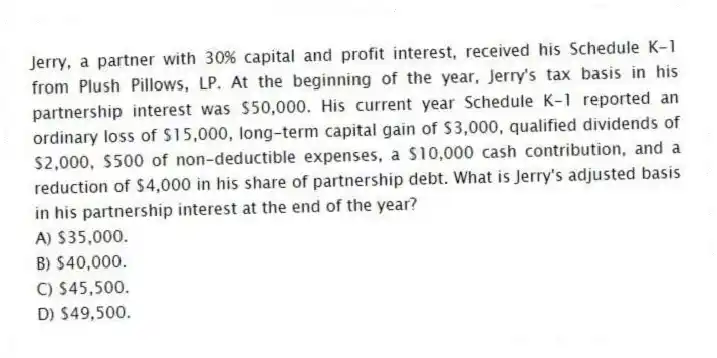

Jerry, a partner with 30% capital and profit interest, received his Schedule K-1 from Plush Pillows, LP. At the beginning of the year, Jerry's tax basis in his partnership interest was $50,000. His current year Schedule K-1 reported an ordinary loss of $15,000, long-term capital gain of $3,000, qualified dividends of $2,000, $500 of non-deductible expenses, a $10,000 cash contribution, and a reduction of $4,000 in his share of partnership debt. What is Jerry's adjusted basis in his partnership interest at the end of the year?

A) $35,000.

B) $40,000.

C) $45,500.

D) $49,500.

Correct Answer:

Verified

Q71: Does adjusting a partner's basis for tax-exempt

Q73: How does additional debt or relief of

Q75: If partnership debt is reduced and a

Q76: Which of the following statements regarding a

Q80: If a taxpayer sells a passive activity

Q81: Lloyd and Harry, equal partners, form the

Q82: Ruby's tax basis in her partnership interest

Q83: KBL, Inc., AGW, Inc., Blaster, Inc., Shiny

Q84: At the end of year 1, Tony

Q90: Jay has a tax basis of $14,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents