Use the following information to answer the question(s) below.

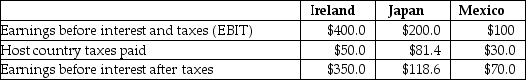

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the U.S.is currently 39%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Japanese and Mexican subsidiaries did not exist,the U.S.tax liability on the Irish subsidiary would be closest to:

A) $81 million

B) $103 million

C) $106 million

D) $156 million

Correct Answer:

Verified

Q25: Use the information for the question(s)below.

Luther Industries,a

Q27: Luther Industries,a U.S.firm.has a subsidiary in the

Q28: Use the information for the question(s)below.

KT Enterprises,a

Q29: Which of the following statements is FALSE?

A)U.S.tax

Q30: Which of the following statements is FALSE?

A)In

Q31: Which of the following statements is FALSE?

A)Other

Q33: Luther Industries,a U.S.firm,is considering an investment in

Q35: Use the information for the question(s)below.

Luther Industries,a

Q36: Which of the following statements is FALSE?

A)Differential

Q40: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents