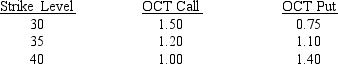

Use the following information on 13-week T-bill rate options to answer the following question(s) .

-Refer to CBOE .Suppose you want to cap your interest rate before a planned October borrowing.What is the cost of using the OCT 35 option to hedge?

A) $110 per contract

B) $1.10 per contract

C) $120 per contract

D) $1.20 per contract

Correct Answer:

Verified

Q2: Outsource,Inc.expects a payment from a French customer

Q3: Use the following information on 13-week T-bill

Q4: A standard "fixed for floating" interest rate

Q5: The Exim Company has entered into a

Q6: You are a financial manager with JCN,Co.and

Q7: Use the following information on 13-week T-bill

Q8: NARRBEGIN: MakeStuff Company

MakeStuff Company

The MakeStuff Company's earnings

Q9: NARRBEGIN: MakeStuff Company

MakeStuff Company

The MakeStuff Company's earnings

Q10: Suppose the spot exchange rate is 0.5491

Q11: The Exim Company has entered into a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents