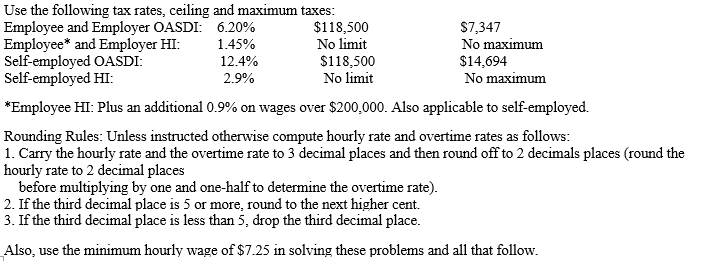

Instruction 3-1

-Refer to Instruction 3-1.On the last weekly pay of the first quarter,Lorenz is paid her current pay of $90 per day for four days worked and one day sick pay (total-$450).She is also paid her first quarter commission of $1,200 in this pay.How much will be deducted for:

a)OASDI tax __________

b)HI tax __________

Correct Answer:

Verified

Q41: Which of the following deposit requirements pertains

Q49: To be designated a semiweekly depositor, how

Q50: Which of the following deposit requirements pertains

Q52: The FICA tax rates for the self-employed

Q60: Which of the following deposit requirements pertains

Q62: Instruction 3-1 Q63: Instruction 3-1 Q63: Refer to Instruction 3-1.Beginning with the first Q64: Instruction 3-1 Q66: Instruction 3-1 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

![]()

![]()

![]()

![]()