Solved

Instruction 3-1 -Refer to Instruction 3-1.Jax Company's (A Monthly Depositor)tax Liability (Amount

Essay

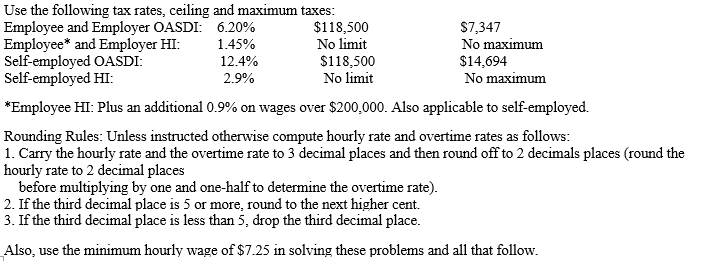

Instruction 3-1

-Refer to Instruction 3-1.Jax Company's (a monthly depositor)tax liability (amount withheld from employees' wages for federal income tax and FICA tax plus the company's portion of the FICA tax)for July was $1,210.No deposit was made by the company until August 24,20--.Determine:

a)The date by which the deposit should have been made

b)The penalty for failure to make timely deposit

c)The penalty for failure to fully pay tax when due

d)The interest on taxes due and unpaid (assume a 3% interest rate)

Correct Answer:

Verified

a)

August ...

August ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions