Solved

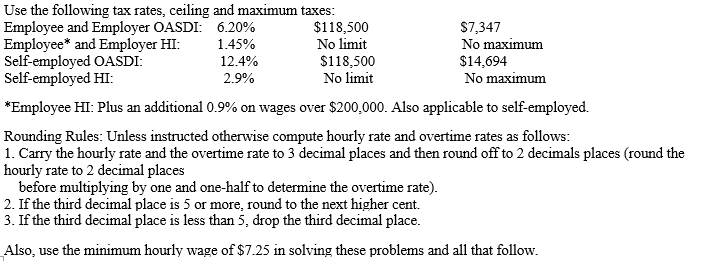

Instruction 3-1 -Refer to Instruction 3-1.On August 1,Huff (Part-Time Waitress)reported on Form

Essay

Instruction 3-1

-Refer to Instruction 3-1.On August 1,Huff (part-time waitress)reported on Form 4070 the cash tips of $158.50 that she received in July.During August,Huff was paid wages of $550 by her employer.Determine:

OASDI

HI

a)The amount of social security taxes that the employer should withhold from Huff's wages during August:

__________

__________

b)The amount of the employer's social security taxes on Huff's wages and tips during August:

__________

__________

Correct Answer:

Verified

OASDI

HI

a...

HI

a...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions