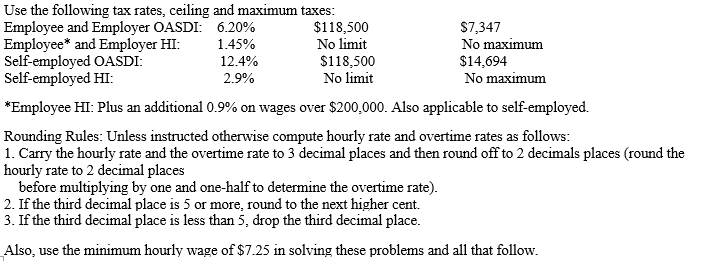

Essay

Instruction 3-1

-Refer to Instruction 3-1.Fess receives wages totaling $74,500 and has net earnings from self-employment amounting to $51,300.In determining her taxable self-employment income for the OASDI tax,how much of her net self-employment earnings must Fess count?

Correct Answer:

Verified

Related Questions