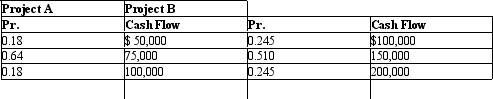

Expected Return. Manhattan Transfer, Inc., is considering two alternative capital budgeting projects. Project A is an investment of $225,000 to renovate warehouse facilities. Project B is an investment of $450,000 to expand distribution facilities. Relevant annual cash flow data for the two projects over their expected five-year lives are as follows:

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

B. Calculate the risk-adjusted NPV for each project, using a 15% cost of capital for the more risky project and 12% for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank them according to their PIs.

D. Calculate the IRR for each project, and rank them according to their IRRs.

E. Compare your answers to parts B, C, and D, and discuss any differences.

Correct Answer:

Verified

Q28: The crossover discount rate only equates the:

A)

Q29: Cost of Capital. Indicate whether each of

Q30: The cost of capital is the:

A) component

Q31: The risk-free rate of return is the

Q32: NPV Analysis. QED Exploration, Ltd., is contemplating

Q34: Cost of Capital. Determine whether each of

Q35: Incremental Analysis. Cunningham's Drug Store, a medium-sized

Q36: Incremental Analysis. Warren Buffet is a medium-sized

Q37: NPV Analysis. Travel Services, Inc., is contemplating

Q38: NPV Analysis. Nocando Retailing, Ltd. is contemplating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents