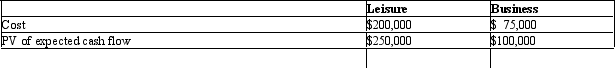

NPV Analysis. Travel Services, Inc., is contemplating purchase of a number of seats on regularly scheduled airlines for resale to leisure and business customers. The company projects the following costs and revenues for each type of service:

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

B. Calculate the profitability index for each service. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the services be undertaken?

Correct Answer:

Verified

Q32: NPV Analysis. QED Exploration, Ltd., is contemplating

Q33: Expected Return. Manhattan Transfer, Inc., is considering

Q34: Cost of Capital. Determine whether each of

Q35: Incremental Analysis. Cunningham's Drug Store, a medium-sized

Q36: Incremental Analysis. Warren Buffet is a medium-sized

Q38: NPV Analysis. Nocando Retailing, Ltd. is contemplating

Q39: When NPV is positive, the IRR:

A) is

Q40: Rate-of-Return Analysis. New York City licenses taxicabs

Q41: Crossover Discount Rates. Sally Rogers is the

Q42: Cost of Capital. Northwest Bankshares, Inc., is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents