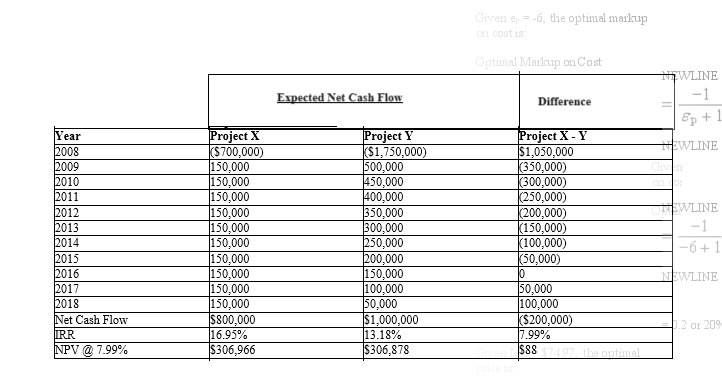

Crossover Discount Rates. Sally Rogers is the chief financial officer for Popular Productions, Inc., producers of The Allan Brady Show, a hit comedy series. Rogers is considering the desirability of purchasing one of two alternative forms of post-production equipment used in the tape editing process. Rogers has discovered that a serious problem can arise when using the NPV method of project valuation because projects sometimes differ significantly in terms of the magnitude and timing of cash flows. When the size or pattern of alternative project cash flows differs greatly, each project's NPV can react quite differently to changes in the discount rate. Changes in the appropriate discount rate can sometimes lead to reversals in project rankings. Rogers discovered this problem when considering the following before-tax cash flow data:

A. Conceptually describe how ranking reversals can occur at the crossover discount rate.

A. Conceptually describe how ranking reversals can occur at the crossover discount rate.

B. Which investment project is preferred at a relevant cost of capital that is below the crossover discount rate? Why?

C. Which investment project is preferred at a relevant cost of capital that is above the crossover discount rate? Why?

Correct Answer:

Verified

Q36: Incremental Analysis. Warren Buffet is a medium-sized

Q37: NPV Analysis. Travel Services, Inc., is contemplating

Q38: NPV Analysis. Nocando Retailing, Ltd. is contemplating

Q39: When NPV is positive, the IRR:

A) is

Q40: Rate-of-Return Analysis. New York City licenses taxicabs

Q42: Cost of Capital. Northwest Bankshares, Inc., is

Q43: Cost of Capital. Dartmouth Systems, Inc., is

Q44: Cash Flow Analysis. The Printing Press, Inc.,

Q45: Cash Flow Analysis. Biometric Devices, Inc., is

Q46: Cash Flow Analysis. Dick Tracy has acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents