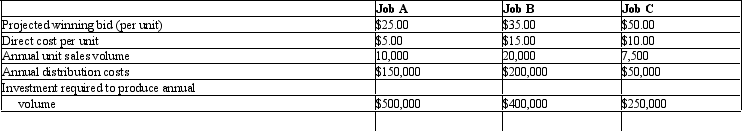

Cash Flow Analysis. The Printing Press, Inc., (PPI) is analyzing the potential profitability of three printing jobs put up for bid by a national textbook publisher:

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 35%, (2) each job is expected to have a five-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 15%, (5) the jobs have the same risks as the firm's other business, and (6) the company has already spent $10,000 on developing the preceding data. This $10,000 has been capitalized and will be amortized over the life of the job chosen, if any.

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 35%, (2) each job is expected to have a five-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 15%, (5) the jobs have the same risks as the firm's other business, and (6) the company has already spent $10,000 on developing the preceding data. This $10,000 has been capitalized and will be amortized over the life of the job chosen, if any.

A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each job? On which job, if any, should PPI bid?

C. Suppose that PPI's primary business is quite cyclical, improving and declining with the economy, which job B is expected to be counter cyclical. Might this have any bearing on your decision?

Correct Answer:

Verified

Q39: When NPV is positive, the IRR:

A) is

Q40: Rate-of-Return Analysis. New York City licenses taxicabs

Q41: Crossover Discount Rates. Sally Rogers is the

Q42: Cost of Capital. Northwest Bankshares, Inc., is

Q43: Cost of Capital. Dartmouth Systems, Inc., is

Q45: Cash Flow Analysis. Biometric Devices, Inc., is

Q46: Cash Flow Analysis. Dick Tracy has acquired

Q47: Incremental Analysis. Grey's Anatomy, Ltd., is contemplating

Q48: Cost of Capital. Marine Transport, Ltd., operates

Q49: Cash Flow Analysis. The Gulf States Press,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents