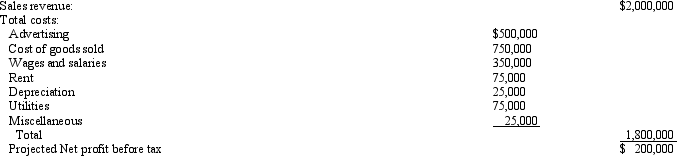

Incremental Analysis. Grey's Anatomy, Ltd., is contemplating opening a new retail outlet in a suburban shopping mall. Projections for an initial 10-year period for the potential outlet are:

A. Calculate the NPV for the proposed outlet assuming that an initial investment of $750,000 is required and the cost of capital is k=20%.

A. Calculate the NPV for the proposed outlet assuming that an initial investment of $750,000 is required and the cost of capital is k=20%.

B. Given the proposed outlet's projected net profit before tax, calculate the maximum initial investment that could be justified when k=20%.

Correct Answer:

Verified

Q40: Rate-of-Return Analysis. New York City licenses taxicabs

Q41: Crossover Discount Rates. Sally Rogers is the

Q42: Cost of Capital. Northwest Bankshares, Inc., is

Q43: Cost of Capital. Dartmouth Systems, Inc., is

Q44: Cash Flow Analysis. The Printing Press, Inc.,

Q45: Cash Flow Analysis. Biometric Devices, Inc., is

Q46: Cash Flow Analysis. Dick Tracy has acquired

Q48: Cost of Capital. Marine Transport, Ltd., operates

Q49: Cash Flow Analysis. The Gulf States Press,

Q50: Cost of Capital. Chock Full O'Coffee, Inc.,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents