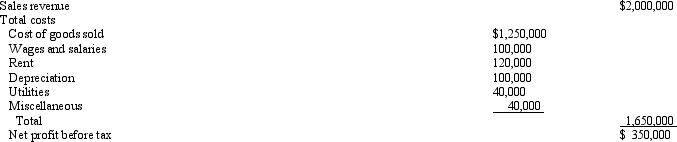

Incremental Analysis. Cunningham's Drug Store, a medium-sized drug store located in Milwaukee, Wisconsin, is owned and operated by Richard Cunningham. Cunningham's sells pharmaceuticals, cosmetics, toiletries, magazines, and various novelties. Cunningham's most recent annual net income statement is as follows:

Cunningham's sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Cunningham is considering using some floor space for a small soda fountain. Cunningham would operate the soda fountain for an initial five-year period, and then reevaluate its profitability. The soda fountain requires an incremental investment of $25,000 to lease furniture, equipment, utensils, and so on. This is the only capital investment required during the initial five-year period. At the end of that time, additional capital would be required to continue operating the soda fountain and no capital would be recovered if it were dropped. The soda fountain is expected to have sales of $125,000 and food and materials expenses of $30,000 per year. The soda fountain is also expected to increase wage and salary expenses by 8% and utility expenses by 5%. Because the soda fountain will reduce the floor space available for display of other merchandise, sales of nonsoda fountain items are expected to decline by 10%.

Cunningham's sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Cunningham is considering using some floor space for a small soda fountain. Cunningham would operate the soda fountain for an initial five-year period, and then reevaluate its profitability. The soda fountain requires an incremental investment of $25,000 to lease furniture, equipment, utensils, and so on. This is the only capital investment required during the initial five-year period. At the end of that time, additional capital would be required to continue operating the soda fountain and no capital would be recovered if it were dropped. The soda fountain is expected to have sales of $125,000 and food and materials expenses of $30,000 per year. The soda fountain is also expected to increase wage and salary expenses by 8% and utility expenses by 5%. Because the soda fountain will reduce the floor space available for display of other merchandise, sales of nonsoda fountain items are expected to decline by 10%.

A. Calculate net incremental cash flows for the soda fountain.

B. Assume that Cunningham has the capital necessary to install the soda fountain and places a 12% before-tax opportunity cost on those funds. Should the soda fountain be installed? Why or why not?

Correct Answer:

Verified

Q30: The cost of capital is the:

A) component

Q31: The risk-free rate of return is the

Q32: NPV Analysis. QED Exploration, Ltd., is contemplating

Q33: Expected Return. Manhattan Transfer, Inc., is considering

Q34: Cost of Capital. Determine whether each of

Q36: Incremental Analysis. Warren Buffet is a medium-sized

Q37: NPV Analysis. Travel Services, Inc., is contemplating

Q38: NPV Analysis. Nocando Retailing, Ltd. is contemplating

Q39: When NPV is positive, the IRR:

A) is

Q40: Rate-of-Return Analysis. New York City licenses taxicabs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents